Federal $2,000 Deposit in 2026 Explained: As 2026 unfolds, conversations around a possible $2,000 federal deposit have gained momentum again. Many taxpayers believe a new rule, benefit, or nationwide payment may have been introduced. This belief is understandable, especially when deposits of similar amounts appear in bank accounts during tax season. However, the reality is far less dramatic than online discussions suggest.

There is no new universal $2,000 federal payment for everyone in 2026. What has changed is the way federal payments, especially tax refunds, are reviewed, verified, and released. Understanding this difference is important so taxpayers know what to expect and do not rely on misleading assumptions.

What the $2,000 Federal Deposit Actually Represents

The $2,000 figure does not point to a new stimulus program or special federal payout. In most cases, it represents the outcome of an individual tax return. Many refunds naturally fall around this amount due to a combination of tax withholding, credits, and adjustments applied during IRS processing.

When employers withhold more tax than necessary throughout the year, that extra amount is returned as a refund. Refundable tax credits can also increase the total. When these factors overlap, the final refund often lands close to $2,000, which explains why this number appears so frequently.

Why $2,000 Refunds Are Common

Refunds near $2,000 often occur because this range sits at the midpoint between basic refunds and larger family-based returns. Taxpayers with moderate income, steady employment, and some credits often fall into this range naturally. Joint filers may also see combined refund totals reach similar figures.

In some cases, prior-year reconciliations or IRS corrections can add to the amount. These are not new payments but delayed or corrected funds that taxpayers were already entitled to receive. This makes the $2,000 amount common but not guaranteed.

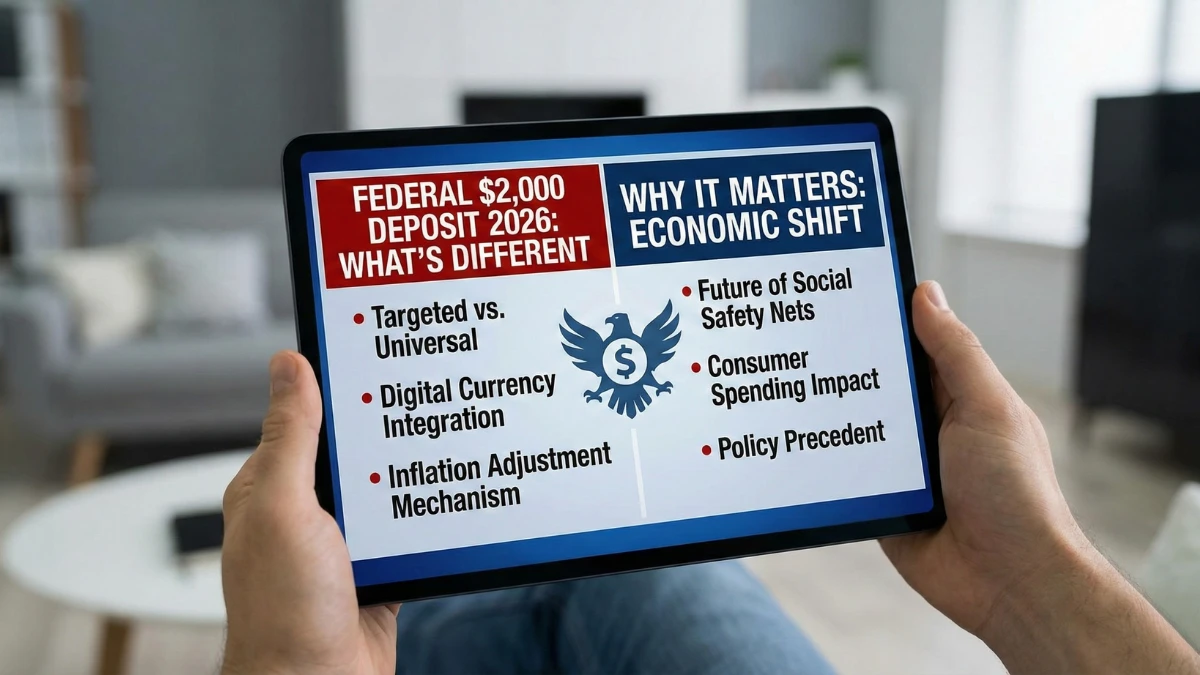

What Is Different About Federal Processing in 2026

The biggest change in 2026 is not the payment amount but the review process. Federal agencies have expanded their focus on verification, fraud prevention, and identity matching. This affects how quickly refunds are approved and released, especially for mid-range amounts.

The IRS has adjusted internal systems to reduce errors and fraudulent claims. While these changes improve long-term accuracy and security, they also make processing feel slower for some taxpayers. Refunds that once moved quickly through automated systems may now be paused briefly for additional checks.

Why $2,000 Deposits Receive More Review

Refunds around $2,000 often sit at the intersection of tax withholding and refundable credits. This overlap makes them more likely to trigger automated screening tools. Very small refunds usually clear quickly, and very large refunds are often expected due to clear eligibility patterns.

Mid-range refunds require closer confirmation to ensure credits and income details match official records. This does not mean there is a problem with the return. It simply reflects a more cautious processing approach in 2026.

Processing Changes That Affect Timing

Several behind-the-scenes updates influence how fast refunds move through the system. Expanded automated screening tools now flag more returns for confirmation. Some cases are routed for manual review when information needs to be cross-checked.

Bank posting schedules also play a role, especially during peak periods. Even after the IRS releases funds, banks may take additional time to post deposits. These combined factors explain why some taxpayers experience delays compared to earlier years.

Does a New $2,000 Federal Payment Exist in 2026

As of now, there is no confirmed nationwide $2,000 federal payment program for 2026. No new law or policy authorizes a universal payout of this amount. Any legitimate deposit near $2,000 comes from standard tax processing or existing benefit systems.

Claims suggesting otherwise are often based on misunderstanding or misinformation. It is important to rely on official IRS announcements rather than online speculation when interpreting payment activity.

Why Payment Amounts Differ Between Taxpayers

Federal payments are calculated individually, not issued as flat amounts. This is why one taxpayer may receive $600, another $1,200, and another $2,000 or more. Income, filing status, dependents, and credits all influence the final result.

These differences do not indicate different programs or special rules. They simply reflect how the tax system adjusts refunds based on personal financial information. Comparing refunds with others often leads to confusion because no two tax situations are exactly alike.

What Taxpayers Should Do During Processing

Taxpayers do not usually need to take action when a refund is under review. Most delays resolve automatically once verification steps are completed. Monitoring refund status through official IRS tools provides the most accurate updates.

Ensuring that tax returns are accurate and complete helps prevent unnecessary delays. Avoiding assumptions based on social media claims can also reduce stress during tax season. Official sources remain the best guide.

The Role of Banks in Deposit Timing

Banks influence when funds actually appear in accounts. Some banks post deposits immediately, while others hold them for internal processing. Weekends, holidays, and high transaction volume can also affect posting times.

This means a refund marked as sent by the IRS may not show up right away. Understanding this gap helps explain why timing varies even after approval.

Why Expectations Matter in 2026

Many taxpayers expect faster processing based on past experiences. However, expanded verification in 2026 means patience is often required. These changes are designed to protect taxpayers and reduce long-term issues, even if they cause short-term delays.

Recognizing that the $2,000 figure is not a guaranteed payment helps set realistic expectations. It prevents unnecessary worry and allows taxpayers to focus on confirmed information.

The $2,000 federal deposit discussed in 2026 is not a new stimulus or benefit rule. It reflects how modern tax refund processing works, especially when withholding, credits, and adjustments overlap. What has changed this year is the emphasis on verification and accuracy, which affects timing and visibility of payments.

Understanding these changes helps taxpayers avoid confusion and unrealistic assumptions. By relying on official IRS tools and accurate filing, individuals can navigate the 2026 tax season with greater clarity and confidence.

Disclaimer

This article is for informational purposes only and does not constitute tax, legal, or financial advice. Federal deposit amounts and processing timelines depend on individual circumstances, IRS rules, and bank policies. Readers should always rely on official IRS notices or consult a qualified professional for personalized guidance.